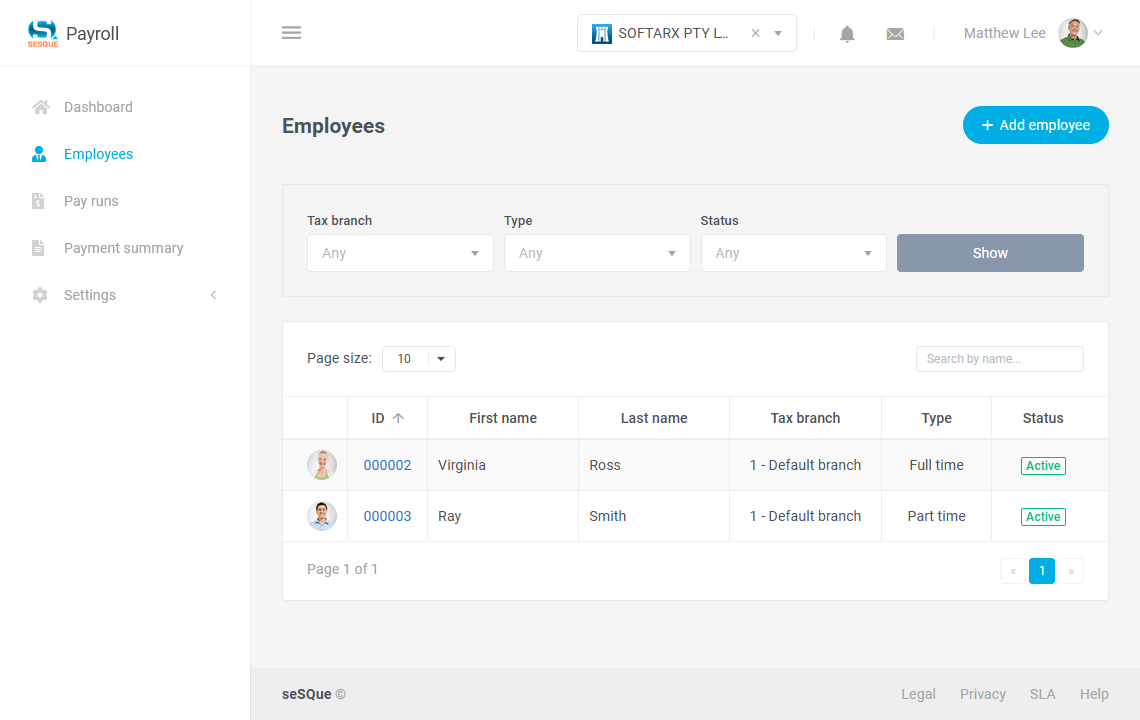

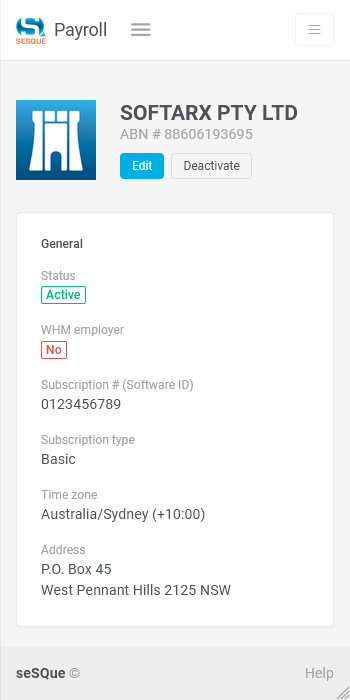

Single Touch Payroll software for Australian businesses

All Australian businesses must report payroll events using ATO compliant Single Touch Payroll (STP) software. seSQue Payroll is an ATO registered STP provider for micro and small businesses, trusted by hundreds of employers.

No credit card required

Ready for more advanced payroll features?

Our Basic subscription is free of charge and includes all the core features needed to run payroll for one employee, making it ideal for owner-only micro businesses.

Designed for growing businesses with more complex needs, our Advanced subscription provides access to additional features like payslips, super payments, reporting and more.

If you're a registered tax or BAS agent, our Ultimate subscription lets you manage your users and quickly switch between business clients without having to log out.

Access payroll anytime, anywhere

Run your STP reports from any device, without having to install and manage a separate app. seSQue Payroll works in your browser and automatically adjusts to your screen size. Whether you're at your desk or on the move, it works just as well on your computer, tablet or phone.

No credit card required